- Details

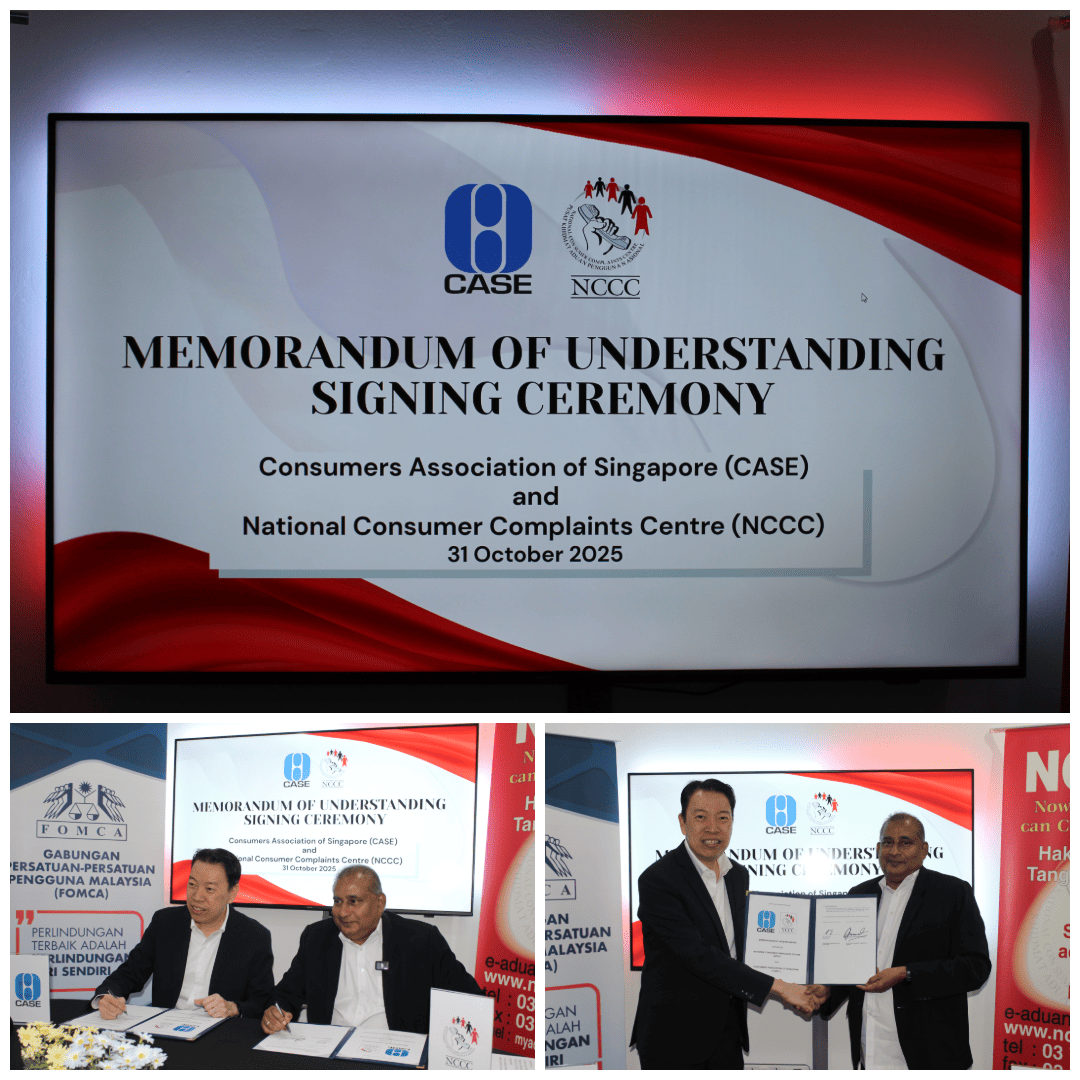

The National Consumer Complaints Centre (NCCC) today signed a Memorandum of Understanding (MoU) with the Consumers Association of Singapore (CASE) to enhance cooperation in handling cross-border consumer complaints between Malaysia and Singapore.

The National Consumer Complaints Centre (NCCC) today signed a Memorandum of Understanding (MoU) with the Consumers Association of Singapore (CASE) to enhance cooperation in handling cross-border consumer complaints between Malaysia and Singapore.

The MoU was signed by Prof. Emeritus Datuk Dr Marimuthu Nadason, Chairman of NCCC, and Mr. Melvin Yong, President of CASE, in Kuala Lumpur. This landmark agreement establishes a dedicated mechanism to help consumers in both countries resolve disputes amicably when purchasing goods or services across borders.

Under this partnership, a consumer who experiences a dispute while shopping or transacting across the Causeway can now lodge a complaint with their home country’s consumer body.

- Malaysian consumers with disputes against businesses in Singapore can file their complaints with NCCC, which will refer them to CASE for mediation

- Similarly, Singaporean consumers with disputes against Malaysian businesses can lodge their complaints with CASE, which will refer the case to NCCC for resolution

This cooperation provides consumers a more accessible, transparent, and efficient redress pathway, without the inconvenience of dealing directly with foreign systems.

- Details

In January 2025, Azrul Mohd Khalib who is the Chief Executive of the Galen Centre for Health and Social Policy, highlighted that an estimated 70% of private hospital charges remain unregulated. This means that hospitals have the liberty to set arbitrary prices for a range of items and services, including essential medical equipment such as wheelchairs, heart monitors, and even emesis basins. Only 30% of hospital bills are regulated, primarily covering specialist fees and medication. This lack of oversight has led to numerous cases where patients unknowingly pay excessive sum of medical bills for items that should otherwise be reasonably priced.

Hidden hospital charges, often labelled as profiteering, are a widespread problem in Malaysia. For example, a simple medical glove that costs RM5 per pair might be billed at RM20. In most cases, this creates an unjust financial burden on patients who pay these inflated charges without question. The issue arises primarily because patients rarely scrutinise their medical bills, either due to a lack of knowledge or because they assume that everything charged is legitimate. As a result, they end up shouldering excessive costs without the ability to challenge these expenses.

One of the most alarming aspects of hidden hospital charges is the suppression of information. Some hospitals use this tactic to increase their revenue without the patient's awareness. A notable NCCC’s case involves Complainant B and Hospital C, where Complainant B’s daughter, a minor under 12 years old, was diagnosed with a cervical cyst. The hospital proceeded with numerous procedures without informing Complainant B that certain treatments were not covered under his company's insurance.

Complainant B, who relied on a Guarantee Letter issued by his company, believed that all medical expenses would be covered. However, despite knowing which procedures were claimable and which were not, the hospital failed to communicate this crucial information. The bulk of the hospital bill was covered by insurance, yet Complainant B was left with an out-of-pocket expense of RM5,000. Following several rounds of negotiation, the hospital agreed to reduce the amount to RM3,500 after a discount. Nevertheless, Complainant B found this sum to be substantial, reinforcing the reality that many patients face when dealing with unexpected hospital charges.

Malaysia's current healthcare system lacks a clear mechanism for patients to challenge such costs, unlike in countries that have implemented price transparency regulations. For instance, the United States of America has introduced the Hospital Price Transparency Rule on 1 January 2021 which makes it a requirement for hospitals to publicly disclose a list of their standard charges for various services. This rule enables patients to compare hospital prices before seeking treatment and allowing them to make informed financial decisions regarding their medical care. Similarly, Singapore is set to introduce the Health Information Bill in mid-2024, which will improve transparency in healthcare pricing and data management. The country also has a robust regulatory system where medical costs in public hospitals are monitored, and pricing is often published online, allowing patients to compare treatment costs across different hospitals.

- Details

SIARAN MEDIA: SAMBUTAN HARI HAK PENGGUNA SEDUNIA 2025 MENEKANKAN PERALIHAN GAYA HIDUP LESTARI SECARA ADIL

Gabungan Persatuan-persatuan Pengguna Malaysia (FOMCA) telah menganjurkan Majlis Perasmian Sambutan Hari Hak Pengguna Sedunia 2025 bertempat di SMK Cheras Jaya pada 17 Mac 2025, yang dirasmikan oleh Yang Berusaha Encik Mohd Zaid Bin Idris, Pengarah Bahagian Gerakan Kepenggunaan, Kementerian Perdagangan Dalam Negeri dan Kos Sara Hidup (KPDN). Majlis sambutan ini turut dihadiri oleh pelbagai pihak berkepentingan termasuk Yang Berbahagia Prof Emeritus Datuk Dr. Marimuthu Nadason, Presiden FOMCA dan juga Consumers International, Ketua Cawangan KPDN Kajang, Jabatan Pendidikan Negeri Selangor, Pejabat Pendidikan Daerah Hulu Langat, Tenaga Nasional Berhad, guru-guru, pelajar dan warga kerja SMK Cheras Jaya, serta wakil media.

FOMCA memilih Majlis Sambutan Hari Hak Pengguna Sedunia tahun ini dibuat di sekolah bagi memberi ruang kepada pelajar, guru dan warga sekolah untuk memahami kepentingan kepenggunaan lestari. Dengan adanya kesedaran yang lebih tinggi, diharapkan masyarakat dapat bersama-sama mengambil langkah untuk memperkukuh usaha ke arah gaya hidup lestari secara adil.

FOMCA menegaskan bahawa perubahan iklim yang semakin ekstrem dan kesan negatifnya terhadap keterjaminan makanan, kepupusan biodiversiti, serta pencemaran alam sekitar memerlukan perhatian serius daripada semua pihak. Krisis ini bukan sahaja memberi kesan kepada alam sekitar tetapi juga kepada ekonomi dan sosial, seterusnya merencat pencapaian Matlamat Pembangunan Lestari (Sustainable Development Goals – SDGs).

Tema "Peralihan Gaya Hidup Lestari Secara Adil" merujuk kepada usaha untuk menggalakkan masyarakat mengamalkan gaya hidup yang lebih mesra alam secara adil, inklusif, dan mampan. Konsep ini menekankan beberapa elemen penting:

- Gaya Hidup Lestari (Sustainable Lifestyles)

- Mengurangkan penggunaan sumber yang berlebihan seperti tenaga, air, dan plastik.

- Mengamalkan penggunaan produk yang lebih mesra alam dan boleh dikitar semula.

- Menyokong kitaran ekonomi dengan mengurangkan pembaziran dan memanjangkan hayat sesuatu produk.

- Menggalakkan diet yang lebih sihat dan mesra alam, seperti mengurangkan pembaziran makanan dan menyokong pertanian yang mampan.

- Peralihan yang Adil (A Just Transition)

- Memastikan perubahan ke arah kehidupan lestari tidak membebankan golongan berpendapatan rendah.

- Menyediakan akses yang saksama kepada sumber yang mampan seperti tenaga boleh baharu, pengangkutan awam mesra alam, dan makanan sihat yang mampu milik.

- Menyokong pekerjaan hijau (green jobs) dan memastikan pekerja dalam industri yang terkesan (contohnya industri bahan api fosil) mendapat peluang pekerjaan alternatif dalam sektor hijau.

- Mengelakkan jurang sosial dengan memastikan semua lapisan masyarakat, termasuk golongan luar bandar dan rentan, mendapat manfaat daripada peralihan ini.

- Tindakan Pengguna dan Komuniti

- Pengguna diberi pilihan yang lebih mudah dan mampu milik untuk membuat keputusan yang mampan.

- Pendidikan dan kesedaran mengenai impak penggunaan terhadap alam sekitar dan kesejahteraan sosial ditingkatkan.

- Kerjasama antara kerajaan, syarikat, dan masyarakat untuk menyediakan infrastruktur dan insentif bagi menyokong amalan lestari.

Contoh Peralihan Gaya Hidup Lestari Secara Adil

- Penggunaan tenaga: Meningkatkan akses kepada tenaga boleh baharu seperti solar dan angin, terutama bagi komuniti luar bandar, tanpa membebankan kos kepada mereka.

- Pengangkutan: Memastikan pengangkutan awam yang cekap, selesa, dan mampu milik supaya lebih ramai orang dapat mengurangkan penggunaan kenderaan persendirian yang mencemarkan alam.

- Makanan: Memastikan makanan sihat seperti sayur-sayuran organik mudah didapati pada harga berpatutan.

- Pembuangan sisa: Menggalakkan kitar semula dengan menyediakan sistem pengumpulan sisa yang lebih mudah dan berkesan.

Segala perubahan dasar polisi yang berkaitan peralihan ke arah gaya hidup lestari perlu dilaksanakan dengan adil supaya setiap individu, tanpa mengira status ekonomi atau lokasi, dapat menikmati faedahnya tanpa menanggung beban yang berlebihan. Ia bukan sahaja penting untuk kesejahteraan alam sekitar tetapi juga untuk memastikan keseimbangan sosial dan ekonomi dalam masyarakat.

Oleh itu, FOMCA menyeru pengguna untuk memainkan peranan lebih aktif dalam mengamalkan gaya hidup lestari melalui pemilihan makanan, cara pergerakan, penggunaan tenaga, serta pemilihan produk dan perkhidmatan yang lebih mesra alam.

PROF EMERITUS DATUK DR. MARIMUTHU NADASON

Presiden

- Details

PRESS RELEASE: WORLD CONSUMER RIGHTS DAY 2025 CELEBRATION EMPHASIZES JUST TRANSITION TO SUSTAINABLE LIFESTYLES

The Federation of Malaysian Consumers Associations (FOMCA) organized the Official Launch of World Consumer Rights Day 2025 at SMK Cheras Jaya on March 17, 2025, which was officiated by Yang Berusaha Encik Mohd Zaid Bin Idris, Director of the Consumer Movement Division from the Ministry of Domestic Trade and Cost of Living (KPDN). The event was attended by various stakeholders, including Yang Berbahagia Prof Emeritus Datuk Dr. Marimuthu Nadason, President of FOMCA and Consumers International, Head of KPDN Kajang Branch, the Selangor State Education Department, The District Education Office of Hulu Langat, Tenaga Nasional Berhad, teachers, students, and staff from SMK Cheras Jaya, as well as media representatives.

FOMCA chose to hold this year’s World Consumer Rights Day celebration at school to provide an opportunity for students, teachers, and the school community to understand the importance of sustainable consumption. With heightened awareness, it is hoped that the community will collectively take steps to strengthen efforts towards a just transition to a sustainable lifestyle.

FOMCA emphasized that the increasingly extreme climate change and its negative effects on food security, biodiversity loss, and environmental pollution require serious attention from all parties. This crisis not only impacts the environment but also the economy and society, hindering the achievement of the Sustainable Development Goals (SDGs).

This year's theme, "A Just Transition to Sustainable Lifestyles," focuses on encouraging society to adopt a more environmentally friendly lifestyle in a fair, inclusive, and sustainable manner. The concept highlights several key elements:

- Sustainable Lifestyles:

- Reducing excessive consumption of resources such as energy, water, and plastic.

- Promoting the use of more eco-friendly and recyclable products.

- Supporting the circular economy by reducing waste and extending the lifespan of products.

- Encouraging healthier and more environmentally friendly diets, such as reducing food waste and supporting sustainable agriculture.

- A Just Transition:

- Ensuring that the transition to sustainable lifestyles does not burden low-income groups.

- Providing equitable access to sustainable resources such as renewable energy, eco-friendly public transportation, and affordable healthy food.

- Supporting green jobs and ensuring that workers in affected industries (e.g., fossil fuel industries) have alternative employment opportunities in the green sector.

- Avoiding social gaps by ensuring all layers of society, including rural and vulnerable groups, benefit from this transition.

- Consumer and Community Action:

- Providing consumers with easier and affordable choices to make sustainable decisions.

- Increasing education and awareness about the impact of consumption on the environment and social well-being.

- Encouraging collaboration between the government, companies, and society to provide infrastructure and incentives to support sustainable practices.

Examples of A Just Transition to Sustainable Lifestyles:

- Energy Use: Increasing access to renewable energy sources such as solar and wind, especially for rural communities, without burdening them with additional costs.

- Transportation: Ensuring efficient, comfortable, and affordable public transportation so more people can reduce their use of private vehicles that pollute the environment.

- Food: Ensuring that healthy foods, such as organic vegetables, are easily accessible at affordable prices.

- Waste Disposal: Encouraging recycling by providing a more efficient and effective waste collection system.

Any policy changes related to the transition towards a sustainable lifestyle must be implemented justly to ensure that every individual, regardless of economic status or location, can benefit without undue burden. This is not only important for environmental well-being but also to ensure social and economic balance in society.

Therefore, FOMCA urges consumers to play a more active role in adopting sustainable lifestyles through choices related to food, transportation, energy use, and the selection of eco-friendly products and services.

PROF EMERITUS DATUK DR. MARIMUTHU NADASON

President

- Details

PELANCARAN MELALUI MEDIA SOSIAL

Link Pelancaran: https://fb.watch/bKtlFNp_8w/

Press Kit for members of Media - https://cutt.ly/3A2OHEX

HARI HAK-HAK PENGGUNA SEDUNIA, 15 MAC 2022

TEMA: KESAKSAMAAN KEWANGAN DIGITAL

Hari Hak Pengguna Sedunia disambut setiap tahun pada 15 Mac untuk meningkatkan kesedaran mengenai hak dan keperluan pengguna. Hari Hak Pengguna Sedunia telah diselaraskan oleh Consumers International dan dilancarkan pada tahun 1983, yang diiktiraf di seluruh dunia. Meraikan hari tersebut merupakan peluang untuk pengguna menuntut perlindungan dan penghormatan hak pengguna. Hari Hak Pengguna Sedunia ini merupakan momen global untuk meningkatkan kesedaran dan memacu perubahan yang bermakna dan berpanjangan mengenai cabaran mendesak yang dihadapi oleh pengguna di seluruh dunia.

Hari Hak Pengguna Sedunia bagi tahun 2022 bertemakan Fair Digital Finance yang bermaksud kesaksamaan dalam kewangan digital.

Meningkatkan Peranan Perkhidmatan Kewangan Digital (PKD)

Perkhidmatan kewangan digital (PKD) dan Teknologi Kewangan telah memacu perubahan ketara di seluruh dunia.

• Menjelang tahun 2024, pengguna perbankan digital dijangka melebihi 3.6 bilion.

• Di negara membangun, perkadaran pemilik akaun yang menghantar dan menerima pembayaran secara digital telah meningkat daripada 57% (tahun 2014) kepada 70% (tahun 2017)

Risiko PKD

Walaupun terdapat banyak faedah perkhidmatan kewangan digital, pelbagai cabaran pengguna dapat dilihat dengan jelas. PKD telah mencipta risiko baru dan juga memburukkan lagi risiko cara tradisional, antaranya ialah:

• Terma tidak dijelaskan pada jualan;

• Caj atau bayaran yang tersembunyi atau dinaikkan;

• Terma dan syarat kontrak yang tidak adil;

• Cabaran Perlindungan Data – Semakin banyak data pengguna yang dikumpul oleh penyedia PKD, semakin tinggi risiko penyalahgunaan data pengguna; dan

• Penipuan – Semua pengguna terutamanya golongan rentan yang berisiko tinggi dengan kes jenayah yang semakin meningkat seperti penipuan, pernyataan palsu, phishing dan juga mudah terpedaya dengan amalan perniagaan yang mengelirukan. Di seluruh dunia terdapat peningkatan sebanyak 149% dalam penipuan perkhidmatan kewangan digital berbanding tahun 2020

Terdapat bukti kukuh yang menunjukkan risiko ini telah meningkat sejak beberapa tahun kebelakangan ini dan krisis seperti pandemik COVID-19 telah menggalakkan lagi risiko ini, di mana pengguna yang rentan lebih senang terdedah akibat kesempitan ekonomi.

Sifat PKD yang berkembang pesat menunjukkan keperluan untuk mengawal selia perkhidmatan dan produk PKD yang lebih inovatif dan berpusat pada perlindungan dan pemerkasaan pengguna.

Kesaksamaan Kewangan Digital

Ahli Pasukan Petugas Hari Hak Pengguna Sedunia, telah mentakrifkan kesaksamaan kewangan digital sebagai produk dan perkhidmatan yang inklusif, selamat dan data peribadi yang dilindungi dan persendirian.

INKLUSIF: Semua pengguna, termasuk golongan yang paling rentan, mesti diberikan kemudahan capaian, infrastruktur dan peralatan digital untuk menyokong dan mengurus kewangan mereka.

SELAMAT : Semua pengguna, termasuk golongan yang paling rentan, mesti dilindungi daripada penipuan, pernyataan palsu dan phishing.

DATA PERIBADI DILINDUNGI DAN PERSENDIRIAN: Semua pengguna, termasuk yang paling rentan, mesti mempunyai data peribadi yang dilindungi dan bersifat persendirian.

PENIPUAN DI MALAYSIA

Pengguna telah hilang jutaan ringgit akibat penipuan. Menurut Jabatan Siasatan Jenayah Komersial (JSJK) Bukit Aman, antara tahun 2019 dan 2020 pengguna telah kerugian sejumlah RM 541.8 juta disebabkan oleh penipuan.

Dengan penumpuan isu Keselamatan, sempena Hari Hak Pengguna Sedunia 2022, FOMCA akan menjalankan tiga program pemerkasaan untuk melindungi pengguna daripada penipuan. Antara program tersebut adalah:

1. FOMCA bersama Bank Negara Malaysia akan melancarkan Majalah Ringgit Digital, yang bertujuan untuk mendidik pengguna, terutamanya pengguna muda untuk mengamalkan gaya hidup mampan dan amalan pengurusan kewangan peribadi di kalangan pengguna Malaysia. Versi Digital Ringgit akan dirasmikan oleh Y Bhg Encik Abu Hassan Alshari Bin Yahaya, Assistant Governor, Bank Negara Malaysia. Majalah Ringgit Digital akan diterbitkan melalui edisi portal Digital yang boleh digunakan untuk berkongsi maklumat dengan pihak berkepentingan terutamanya pengguna. Ia akan diterbitkan setiap 2 bulan sekali. Ia juga boleh didapati di laman web FOMCA dan Bank Negara Malaysia.

Link: https://cutt.ly/kA2UtAd

2. Mewujudkan kesedaran melalui media sosial (Tiktok, Facebook dan Instagram) – FOMCA akan bekerjasama dengan influencer dalam menyampaikan mesej kesedaran mengenai penipuan. Mesej kesedaran tersebut akan menumpukan tiga kes penipuan online yang berbeza yang diterima oleh National Consumer Complaints Centre (NCCC).

Link: https://fb.watch/byMZrEe6ok/

3. FOMCA juga akan memuat naik program pendidikan pengguna mengenai tips perlindungan diri daripada penipuan perbankan, penipuan pelaburan serta penipuan yang lain. FOMCA akan bekerjasama dengan pihak berkuasa yang berkaitan untuk membangunkan bahan pendidikan tersebut. Program pendidikan yang pertama mengenai Penipuan Kewangan akan dimuat naik pada 15 Mac 2022.

Link: https://fb.watch/bKsJP2tF94/

Bagi memastikan KESAKSAMAAN KEWANGAN DIGITAL untuk masyarakat pengguna, FOMCA akan terus memberikan tumpuan untuk melindungi pengguna daripada sebarang penipuan.

- Details

PRESS RELEASE / SIARAN MEDIA

10th MAY 2021

HAS YOUR INSURANCE COMPANY INCREASED THE PRICE OF YOUR MEDICAL PREMIUMS?

FOMCA has been recently receiving many complaints from policy holders of medical insurance of indiscriminate increase in the price of their premiums. We are concerned of how extensive this issue this and how many consumers have been similarly affected by the price increase of their premiums.

We call on all consumers with medical insurance policies to inform us of the price increase of your premiums and for those who have not received any notices of price increase in your medical insurance to contact your agent and ask him/her if there is indeed any increase in the price of your medical premiums.

At the current time, with unending lockdowns and conditional lockdowns, many consumers have been severely affected either through loss of jobs or reduction in incomes. This is certainly not the time to increase insurance premiums.

It is certainly wrong and unacceptable that insurance companies, at this time raise premium prices to make excessive profits. Consumers are already suffering.

If based on your feedback, we find that many consumers have been forced to pay increasing medical premiums, FOMCA will be launching a National Campaign to urge Bank Negara Malaysia to Stop the Increase in Medical Premiums.

Consumers are facing tremendous economic pressure due to job loss, income loss and economic insecurity. Now is certainly not the time to increase medical insurance premiums.

As a responsible regulator, Bank Negara Malaysia, to protect consumers, should have already pre-emptively directed insurance companies not to increase premiums at his point of time.

Please provide the feedback to FOMCA to enable us to know if you have been affected by the price increase of your medical insurance premium?

Let us as consumers act together to protect our interests.

These are the information we need

- Insurance Company

- Current Annual Insurance Premium (RM)

- New Annual Insurance Premium (RM)

You may email us the details at This email address is being protected from spambots. You need JavaScript enabled to view it. or via this online form https://www.surveymonkey.com/r/PriceHike .

Kindly visit our webpage www.fomca.org.my for more information.

- Details

February 16, 2021 @ 3:23pm

February 16, 2021 @ 3:23pm

KUALA LUMPUR: The Federation of Malaysian Consumers Associations (Fomca) has called for the authorities to categorise retail workers as frontliners.

Its president, Datuk Dr Marimuthu Nadason, cited the Jalan Telawi cluster which was a case of supermarket workers becoming infected with the Covid-19 virus.

"Supermarket and retail outlet workers have extensive exposure daily to their customers. During the entire pandemic, retail stores have been open to cater to the needs of the rakyat for food and other essentials.

"Retail workers are exposed to their customers, including those who may refuse or neglect to follow the standard SOPs such as wearing masks or keeping a 1m distance from others. This exposes the workers to risk," he said in a statement, today.

On the other hand, he said, if for some reason the workers themselves are infected, especially with no symptoms, they can be a source of infecting other workers and customers, exposing consumers to risk.

Marimuthu added that in some ways, retailers have been on the frontline throughout the pandemic serving consumers in which they live and work.

Throughout the pandemic, consumers have had access to food and other essentials, a crucial component in enabling consumers in facing the lockdowns, he said.

"As such Fomca urges the authorities to move retail workers to the front of the line for early inoculation.

- Details

January 15, 2021 2:13 PM

January 15, 2021 2:13 PM

PETAING JAYA: The Federation of Malaysian Consumers Associations (Fomca) has urged the government to offer workers a minimum wage and extend the loan moratorium in the wake of the second movement control order (MCO).

Its president, Marimuthu Nadason, said the government must seriously consider the impact the reimposed MCO will have on workers and businesses.

“They will need financial support. Fomca urges that all affected businesses and workers will be supported at least with a minimum wage to help them through the crisis. Abandoning the workers without any support is just plain cruel.

“Next, Fomca calls on Bank Negara to extend the loan moratorium until at least August. Bank Negara’s silence and indifference to the plight of the rakyat is deafening. There should be an immediate moratorium on all loans to assist those impacted by the MCO,” he said in a statement.

He also suggested that insurance companies be prevented from increasing premiums during the period.

While movement restrictions were necessary, Marimuthu said, it was important to ensure vulnerable communities were not left behind.

“Let us not forget or neglect the low income and the vulnerable who are suffering and will be impacted even worse by these new measures. A responsible government should take concrete and firm measures to support them,” he said.

According to the Malaysian Employers Federation, the economic fallout of the various movement restrictions caused 30,000 businesses to cease operations, resulting in 100,000 job losses, last year.

- Details

15 Jan 2021

15 Jan 2021

LETTER | It has indeed been a harsh new reality for consumers living under the Petaling Jaya City Council (MBPJ).

In its obsession to “go digital”, MBPJ is demanding that assessment billing can only be made through digital means, without an alternative, and further warning that the council will not entertain exceptions for late payments. Harsh action that reflects how the local government has not considered the plight of the digitally disadvantaged.

They seem to deny that there is gross digital inequality between the rich and the poor; the rural and the urban and the able and senior citizens. There are indeed many poor and vulnerable groups in MBPJ's jurisdiction who due to poverty, lack of confidence or digital skills are unable to navigate the digital world confidently. They also deserve fairness and justice.

Even private utility companies provide online as well as physical bills and incentivise consumers through discounts to shift towards online billing platforms. The authorities should indeed be more sensitive towards the suffering of the vulnerable rakyat.

No effort has been made to identify and empower vulnerable consumers to help them through the process.

What is extremely disappointing are the so-called counsellors and local politicians who we had hoped would act to protect consumers and enhance their well-being. They have chosen to remain silent instead.

It is indeed laudable for the local government to go digital. It reduces paper wastage as well as brings savings to the agency. But please think of the welfare of all the rakyat, not just the technically savvy.

Read more: LETTER | Digital inequality in PJ - seniors disadvantaged

- Details

5 Jan 2021 | Tuesday

5 Jan 2021 | Tuesday

LETTER | The year 2020 was supposed to be the year we became a “developed” nation. Instead, it was a year of great suffering for many workers and consumers. It was a year of a health crisis as well as an economic crisis.

As a health crisis, many lost their loved ones or were infected by the dreaded disease. Apart from a strictly physical health crisis, it affected others more deeply.

Mental health issues have increased. Suicides have increased. Beyond that, there were reports of increasing domestic violence.

As an economic crisis, many lost their jobs or had their incomes reduced. Many were stuck with debts or commitments they could not fulfil. Basic needs were affected. Children’s education was affected.

None of this is new. But how do we move forward from here into 2021? There was indeed much suffering, but there are also some lessons to be learnt.

One simple message going viral that “2020 was not a year to expect and plan for what we do not have but appreciate what we do have” can be a start. Let me add some other thoughts.

We need to invest in our health. We do not know when this pandemic will end or the next begin. The next pandemic is not an 'if' but a 'when'. We need to take care of our health and strengthen our immune systems. The suggestions are nothing new: healthier food, exercise, and adequate sleep.

Furthermore, we need to invest in supplements and regular check-ups. Will these protect us? If not completely, certainly they can contribute, to some extent, to reducing the risks and mitigating the negative impacts.

Read more: LETTER | Some lessons we can learn amidst much suffering

Subcategories

Page 1 of 3