As has been made public last year, the motor insurance industry in Malaysia is heading towards the eventual removal of tariffs, with full market liberalisation to come in 2019. The move will have a huge impact on things for everyone – find out how you will be affected in this article, done in partnership with AIG.

In the automotive world, it’s a major shift, because one won’t be paying for motor insurance on a fixed price basis as is the case now. Currently, motor insurance premiums for comprehensive coverage are determined by a regulated tariff, based on fixed factors such as the sum insured, vehicle model, age and engine capacity.

As such, consumers in Malaysia have been paying a fixed price for their motor insurance, no matter which company they buy that insurance from. Purely based on the set factors mentioned above, all insurance providers will offer the same price for your vehicle comprehensive insurance.

That will soon change, with the roll out of motor insurance liberalisation starting from July 1, 2017. With a liberalised market, fixed insurance premiums based on set tariffs and price lists will be a thing of the past in Malaysia.

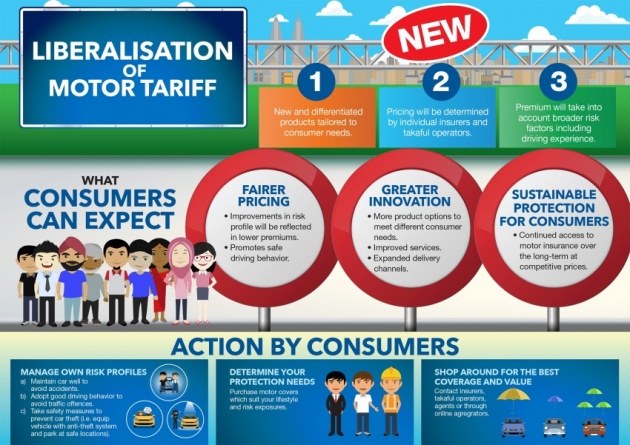

Instead of relying purely on the overly simplistic set factors above, your own risk profile will also be taken into account in the new liberalised market. Essentially, you could pay less – or more – to insure your ride, depending on a number of new factors (detailed below).

This also means that theoretically, no two insurers will have identical pricing for a motor comprehensive policy. With a liberalised market, consumers will have the ability to shop around and compare motor insurance products with different prices and value added items.

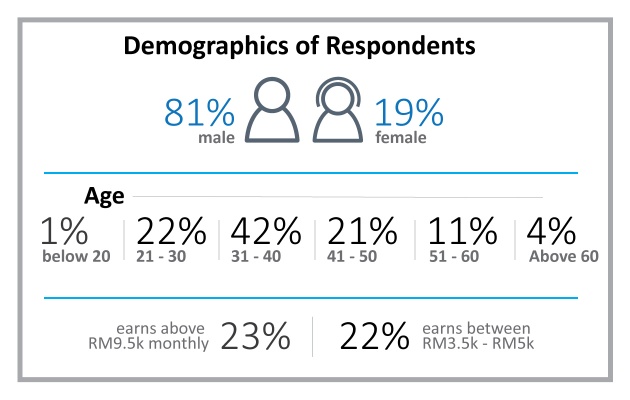

It’s going to eventually be a very open and highly competitive marketplace, and perhaps a little confusing at the start. In partnership with AIG, we ran a quick survey on paultan.org to find out how much you may know about motor insurance liberalisation.

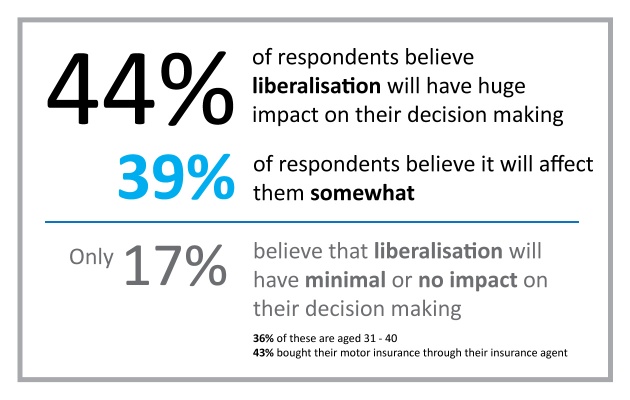

We had over 4,400 respondents within a week – thanks again for that, very much appreciated – and the statistics are quite interesting: while only 42% of respondents are aware that motor insurance is currently a tariffed product in Malaysia, up to 83% think motor insurance liberalisation will have an impact on their next motor insurance renewal.

This is quite telling, really. While the exact details and parameters of the market liberalisation – whether at the starting stage or full-on detariffication when it comes – have not been made public just yet, motorists are pretty much aware that there is a big change coming, and that it will make a difference on how they choose insurance providers.

Why and how will it change your decision making?

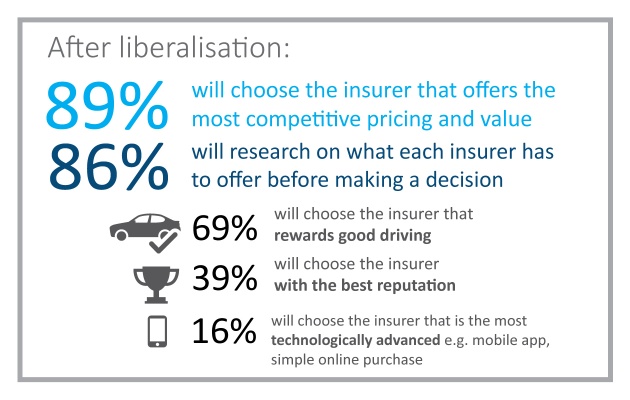

Unsurprisingly, 89% of the survey respondents will choose the insurer that offers the most competitive pricing and value. What Malaysians deem as competitive pricing will be an interesting space to watch. Clearly, while price is a determining factor for most consumers, it is equally clear that research will be a key activity before a buy decision.

That in itself is a big change from the current system. Under a tariffed market, your insurance premium will be the same regardless of your preferred insurance provider, as explained above. For the same vehicle (identical sum insured), plus identical add-on products, you’ll pay the same amount wherever you go.

That won’t be the case once market liberalisation kicks in. Insurance providers will then have a more open market to play with – to offer more affordable packages, or to include additional product coverage to be more attractive than others. Motorists can then shop around to find the ideal provider, based on both price and product offerings.

Research is key, and good drivers will be rewarded

This leads nicely to the second most popular answer: 86% of respondents will research on what each insurer has to offer before making a decision. Something that was not really necessary before, this will now be more important to get exactly the plan that you want. One insurance provider may be more affordable, but others may offer better product coverage – the choice is ultimately yours.

Next, 69% said that they will choose the insurer that rewards them for their good driving. This will be more than the simple No-Claims Discount (NCD) system that is currently in effect. Insurers may offer more rewards for those with better driving records than others.

The liberalisation of motor insurance is targeted at improving safety on the road, incentivising good risk management and inculcate safer driving habits. This will reward good drivers with no history of claims or reckless driving – a good driving record improves your risk profile, so it makes sense for you to pay less.

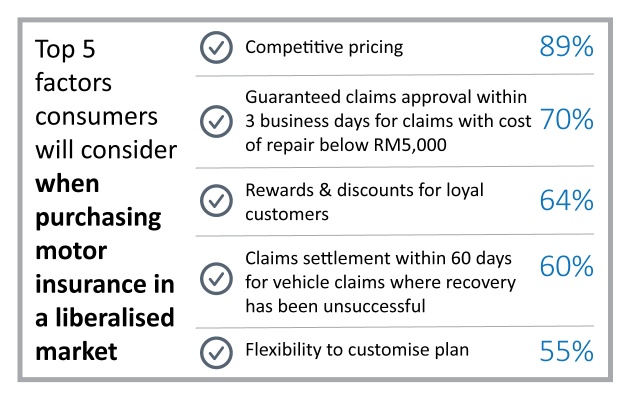

Top factors for choosing insurance provider

As for the top factors that respondents would consider when purchasing motor insurance in a liberalised market, the top choice, with 89% choosing this, is again, competitive pricing. As mentioned above, proper research and good driving will get you the best prices.

Second, though, is guaranteed claims approval within three days for claims (with cost of repair below RM5,000). Speed is almost as important as pricing, it seems, and insurance providers with the best turn-around time in the approval of motor claims will be the preferred choice among motorists.

Third in the list is rewards and discounts for loyal customers. If you’ve used the same insurance provider for years and years, should you get loyalty discounts? Well, while it would not have been possible before, in a liberalised market, that will be entirely possible. Should a provider have such loyalty offers, that may even influence you to stick to the same company come the next renewal time.

Motor insurance purchase/renewal – now available across multiple platforms

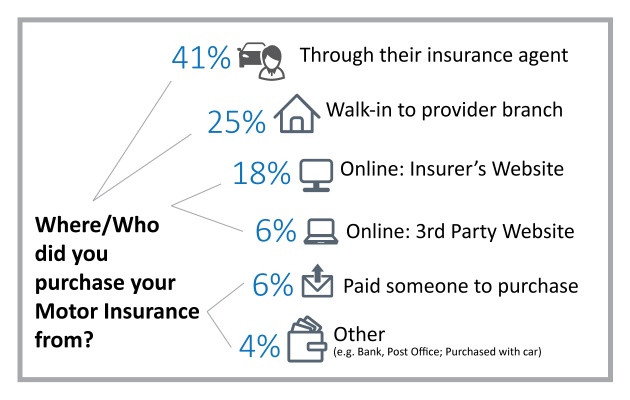

Speaking of researching, a liberalised market should bring about a big shift in how motorists purchase their motor insurance policies. As expected, 41% of our survey respondents still rely on insurance agents for insurance premium renewals, while 25% visit insurance provider branches. A significant amount do it online: 18% through the insurer’s website, and just six percent through third-party websites.

With research being such a vital step in choosing the right insurance policy, it will be doubly important for providers to have an efficient customer service (be it a call centre or the front counter) as well as having all the necessary information readily available through various platforms (physical outlets, website or via agents).

Motor insurance purchase and/or renewal will become easier than ever, with multiple platforms available to the consumers: online, walk-in service and agents. Insurance providers with experienced agents will surely have an advantage here, in being able to explain and offer a customised insurance policy that is ideal for you. Ease and convenience is another important factor, of course, such as being able to do an instant renewal online, complete with road tax renewal and delivery.

In short – how this will affect you and how you can benefit from it

With insurance providers offering different pricing, products, offers and customisability, savvy motorists wanting to get the best deals and the ideal coverage package will have to shop around between insurance providers, before choosing their preferred company. As always, the end-user will benefit the most from an open and highly competitive marketplace.

Motor insurance prices will no longer be fixed – other than the sum insured, engine capacity and the age of vehicle, premiums will soon be driven by other factors, including your own driving behaviour and record, the safety and security features in the vehicle and even where it is parked (avoid areas with higher incidents of theft).

In essence, you’ll have a more direct control over your motor insurance premium – lower your risk profile and you’ll pay less, and you can purchase insurance policies that suit your lifestyle and risk exposures better (with new and differentiated products tailored to your needs). Put simply, you’ll have more control over what you pay for.

On the whole, you can expect insurance providers to offer more innovative products, smoother and more efficient services and fairer (taking into account broader risk factors and driving experience), more competitive pricing with the liberalisation of the motor insurance market.

So dear readers, do let us know your thoughts and wishes for the upcoming liberalised motor insurance market in Malaysia. This article was done in partnership with AIG.

Source : - https://paultan.org/2017/05/09/motor-insurance-liberalisation-how-will-it-affect-you/